News round-up, April, 6, 2023

Most read…

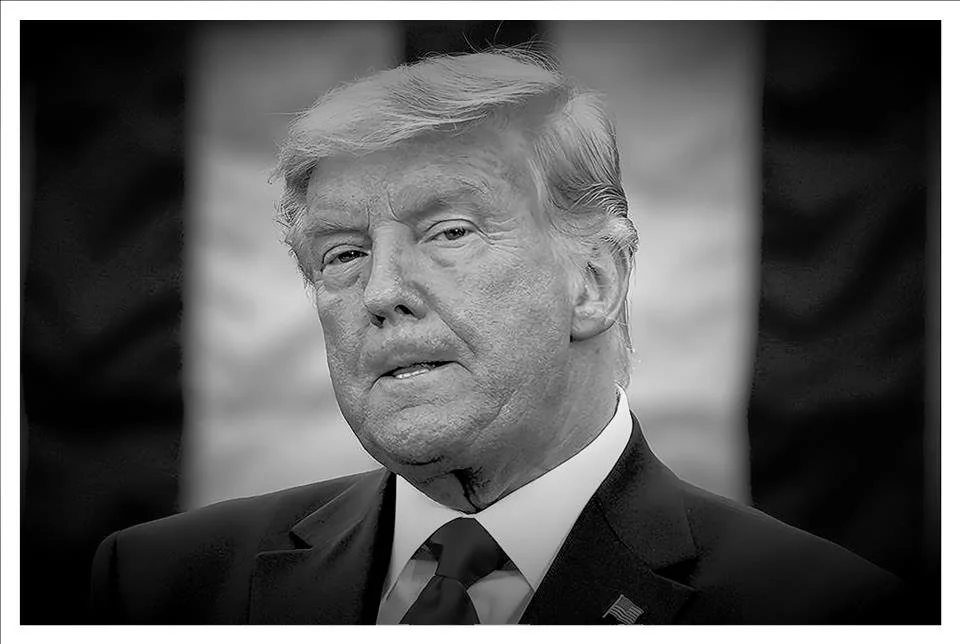

America’s First Indicted Ex-President Is Very Sorry—for Himself

“Notes on Donald Trump’s day in court…

THE NEW YORKER by Susan B. Glasser, April 5, 2023India's power output grows at fastest pace in 33 years, fuelled by coal

Intense summer heatwaves, a colder-than-normal winter in northern India, and an economic rebound caused a rise in electricity consumption, India is forced to increase output from coal plants to prevent power outages.

REUTERS BY MATTHEW CHYE AND CARMAN CHEWAnalysis: A Surprise Accusation Bolsters a Risky Case Against Trump

The unsealed case against Donald J. Trump accuses him of falsifying records in part to lay the groundwork for planned lies to tax authorities.

NYT by Charlie Savage, Published April 4, 2023Exclusive: German insurers renew cover for blast-damaged Nord Stream gas link

“All indicate the pipeline's potential to resume operations following an alleged sabotage attack…

“According to five sources with knowledge of the situation, German insurers Allianz and Munich Re have extended their coverage for the damaged Nord Stream 1 gas pipeline, which is under the control of Russia. ..

REUTERS BY JONATHAN SAUL, CAROLYN COHN, CHRISTOPH STEITZ AND JOHN O'DONNELL, EDITING BY GERMÁN & COChina sends carrier group off Taiwan coast ahead of US meeting

China staged war games around Taiwan last August following the visit to Taipei of then-House Speaker Nancy Pelosi.

Reuters, TodayChina accuses U.S. of using Taiwan as ‘ATM for American arms sellers’

Taiwan is allegedly being utilized by the United States as a "chess piece" in a containment strategy and as a "ATM for American armaments vendors," according to China Central Television.

TWP by Christian Shepherd and Vic Chiang, TODAYEnergy firms bet big on German port as clean energy hub

The company stated in an email response that "feasibility studies are presently being developed for both projects, which will provide further insights into their practicability."

REUTERS By Vera Eckert, TODAY, EDITING BY GERMán & COImage: Germán & CoMost read…

America’s First Indicted Ex-President Is Very Sorry—for Himself

Notes on Donald Trump’s day in court.

THE NEW YORKER By Susan B. Glasser, April 5, 2023India's power output grows at fastest pace in 33 years, fuelled by coal

Intense summer heatwaves, a colder-than-normal winter in northern India, and an economic rebound caused a rise in electricity consumption, India is forced to increase output from coal plants to prevent power outages.

REUTERS BY MATTHEW CHYE AND CARMAN CHEWAnalysis: A Surprise Accusation Bolsters a Risky Case Against Trump

The unsealed case against Donald J. Trump accuses him of falsifying records in part to lay the groundwork for planned lies to tax authorities.

NYT By Charlie Savage, Published April 4, 2023Exclusive: German insurers renew cover for blast-damaged Nord Stream gas link

“All indicate the pipeline's potential to resume operations following an alleged sabotage attack…

According to five sources with knowledge of the situation, German insurers Allianz and Munich Re have extended their coverage for the damaged Nord Stream 1 gas pipeline, which is under the control of Russia.

REUTERS BY JONATHAN SAUL, CAROLYN COHN, CHRISTOPH STEITZ AND JOHN O'DONNELL, EDITING BY GERMÁN & COChina sends carrier group off Taiwan coast ahead of US meeting

China staged war games around Taiwan last August following the visit to Taipei of then-House Speaker Nancy Pelosi.

Reuters, TodayChina accuses U.S. of using Taiwan as ‘ATM for American arms sellers’

Taiwan is allegedly being utilized by the United States as a "chess piece" in a containment strategy and as a "ATM for American armaments vendors," according to China Central Television.

TWP By Christian Shepherd and Vic Chiang, TODAYEnergy firms bet big on German port as clean energy hub

The company stated in an email response that "feasibility studies are presently being developed for both projects, which will provide further insights into their practicability."

REUTERS By Vera Eckert, TODAY, EDITING BY GERMán & CO“We’re living in a volatile world…

it’s easy to get distracted by things like changeable commodity prices or a shortage of solar panels. But this wouldn’t be true to our purpose – we can’t allow ourselves to lose sight of our end goal; said Andres Gluski, CEO of energy and utility AES Corp

Today's events

〰️

Today's events 〰️

Donald Trump spoke to a crowd of fans at Mar-a-Lago shortly after his arraignment, in Manhattan, on numerous felony charges.Photograph by Todd Heisler / NYT / ReduxAmerica’s First Indicted Ex-President Is Very Sorry—for Himself

Notes on Donald Trump’s day in court.

THE NEW YORKER By Susan B. Glasser, April 5, 2023By the time Donald Trump marched out from behind a phalanx of American flags and emerged into the gilded Mar-a-Lago ballroom to speak to cheering supporters on Tuesday night, America’s first indicted ex-President hardly seemed chastened by his historic day as a defendant in a Manhattan courtroom. He told the crowd that prosecutors investigating him were “racist” or “lunatic.” He criticized the judge in his case. He criticized the judge’s daughter. He lied about matters large and small, and expounded at length on everything from “Russia, Russia, Russia” to “Hunter Biden’s laptop from Hell.” He even attacked the National Archives and Records Administration as a “radical-left troublemaking organization.”

Indicted and Arraigned Trump, in other words, turned out to be just like his most recent previous incarnation, Impeached and Defeated Trump: a rambling, unrepentant grievance machine so beloved by his superfans in the Republican Party that he remains the front-runner for the G.O.P. nomination in 2024, even after everything.

Since last Thursday, when the Manhattan District Attorney, Alvin Bragg, secured Trump’s historic indictment, an unrealistic sense of expectation had built up around Tuesday’s arraignment of the former President, as if it were going to be, in and of itself, Trump’s long-awaited day of reckoning. But of course it was not. The charges, when finally unveiled, on Tuesday afternoon, were thirty-four felony counts stemming from alleged efforts by Trump to suppress sordid stories before the 2016 election with hush-money payments. But no major new evidence or surprise witnesses were revealed, and the next court appearance in the case won’t take place until December. Many legal analysts, including even “hard-core Democrats,” as Trump gleefully put it during his nighttime Mar-a-Lago speech, were soon casting doubt on Bragg’s decision to pursue a case that other prosecutors had declined to bring. If this was a reckoning, it didn’t seem all that much like one for an ex-President who, little more than two years ago, was urging a violent mob of his supporters to march on the U.S. Capitol and stop Congress from certifying his 2020 election defeat.

What it seemed like, instead, was the kind of televised spectacle that Trump both craves and excels at creating. The television networks remain more than willing to oblige, broadcasting each step in Trump’s return to New York to surrender to the authorities with a tone of breathless incrementalism that made for hours of exhausting but largely uneventful coverage: Trump has entered the building! Trump has left the building! Trump, Trump, Trump! What a long day of minutiae. I watched his motorcade leave Trump Tower, just after 1 p.m. Minutes later, I watched live as his motorcade arrived at the Manhattan Criminal Courthouse. As far as I could tell, no breaking news occurred in the course of the short trip downtown from Trump Tower.

The endless vamping by cable-news anchors was tedious—think rain-delay-at-the-World-Series-level tiresome—but at least it wasn’t as hard to take as the obvious trolling of the public by Trump and his team. The former President, according to a “source familiar” with Trump’s state of mind who was quoted on Twitter by a CBS News reporter, was said to be “resolute, determined, and fighting for all Americans against injustice, persecution, and weaponization.” Yeah, right. It’s not yet clear whether crying persecution by the prosecution will be good for Trump’s legal fortunes, but it is already abundantly clear that the TV drama has been good for his political coffers: Trump’s campaign, after bragging that he’s already raised more than seven million dollars as a result of Bragg’s indictment, began sending out fund-raising e-mails using his “NOT GUILTY” plea even before he had entered it. Hours before Trump had retreated back to Florida, you could get a T-shirt emblazoned with a fake mug shot of the former President for a contribution of a mere forty-seven dollars to the campaign.

For a historic day, it was notably unrevelatory. The big surprise, in fact, was that there was no surprise. Before Bragg’s sealed indictment was revealed, it seemed that the case would be centered on the years-old allegations involving hush-money payments made to the former porn performer known as Stormy Daniels, with Trump’s disgruntled former fixer Michael Cohen and Daniels as key witnesses. And that is what it turned out to be. Reading the official “statement of facts” that Bragg’s prosecutors filed along with the indictment was like returning to an old book that you’d read with great interest many years ago, but whose particulars you’d long since forgotten. The tawdry, embarrassing story behind the “Catch and Kill Scheme to Suppress Negative Information” in the 2016 election, as the prosecutors’ memo described it, was not new. Much of this has been known since 2018, when the Wall Street Journal published the first scoop about the hundred-and-thirty-thousand-dollar payoff to Daniels; many other reports followed, including great work by my colleague Ronan Farrow, who extensively reported on how the National Enquirer tabloid worked its “catch and kill” tactics on Trump’s behalf. Cohen, who handled payoffs for Trump before renouncing him, eventually even testified about the ex-President’s “dirty deeds” in a public congressional hearing, in early 2019. The flashy evidence produced that day included a photocopy of a check from Donald J. Trump’s personal bank account that, Cohen said, had been used to reimburse him for buying Daniels’s silence about her assignations with Trump.

It felt odd to read about all of this once again, in 2023. The Stormy Daniels affair, after all, was so many Trump scandals ago. Before impeachment No. 1 and Trump’s refusal to concede the 2020 election. Before January 6th and impeachment No. 2. In contrast, the fact that Trump slept with a porn star and paid her off to keep quiet about it before an election seems like the kind of old-fashioned political contretemps that might be bad for a politician’s image—and marriage—and even quite possibly illegal, but which hardly threatens to shake the foundations of American democracy.

In a press conference on Tuesday, shown on CNN with a split screen as “Trump Force One” taxied for takeoff at LaGuardia Airport, Alvin Bragg piously spoke of his “solemn responsibility to insure that everyone stands equal before the law.” Bragg may yet mount a strong legal case for Trump’s culpability; it’s impossible to tell from the bare-bones listing of charges released yesterday. But one thing is already apparent from Tuesday’s proceedings: a courtroom resolution rendering judgment on the former President’s guilt or innocence will be many months, if not years, in the future.

In the meantime, Bragg’s filing of the charges has had an electrifying effect on Trump’s reëlection campaign, offering the ex-President a new grievance to fuel his comeback bid at just the moment when he needs something to galvanize his effort and distract the Republican Party from the growing concerns about his losing record. The short-term boon is real, if possibly quite temporary: since news of the case broke, polls have shown Trump with his biggest leads in the G.O.P. primary so far, and even Trump-skeptical Republicans, such as Mitt Romney, found themselves leaping to his defense against what they insist is a politically motivated prosecution.

None of this may matter several months from now. Trump faces far more serious potential prosecutions in cases involving his efforts to overturn the 2020 election and his possession at Mar-a-Lago of classified documents from his Presidency. If charges are forthcoming in any of those investigations, Manhattan indictment No. 71543-23 may end up as little more than a footnote to history, the first but not the last time that a prosecutor dared to call a former President a crook in a court of law. But what a footnote it will be. ♦

Image: A view of an under-construction coal jetty of the planned 1,320-megawatt power plant on the coastline near India's southern tip, in Udangudi, Tamil Nadu, India, October 13, 2021. Picture taken October 13, 2021. REUTERS/Sudarshan Varadhan/Editing by Germán & CoIndia's power output grows at fastest pace in 33 years, fuelled by coal

Intense summer heatwaves, a colder-than-normal winter in northern India, and an economic rebound caused a rise in electricity consumption, India is forced to increase output from coal plants to prevent power outages.

REUTERS By Matthew Chye and Carman ChewSINGAPORE, April 5 (Reuters) - India's power generation grew at the fastest pace in over three decades in the just-ended fiscal year, a Reuters analysis of government data showed, fuelling a sharp surge in emissions as output from both coal-fired and renewable plants hit records.

Intense summer heatwaves, a colder-than-usual winter in northern India and an economic recovery led to a jump in electricity demand, forcing India to crank up output from coal plants and solar farms as it scrambled to avoid power cuts.

Power generation rose 11.5% to 1,591.11 billion kilowatt-hours (kWh), or units, in the fiscal year ended March 2023, an analysis of daily load data from regulator Grid-India showed, the sharpest increase since year ended March 1990.

Output from plants running on fossil fuels rose 11.2%, the quickest growth in over three decades, thanks to a 12.4% surge in electricity production from coal, the analysis showed, offsetting a 28.7% decline in generation from cleaner gas-fired plants as a global spike in LNG prices deterred usage.

In the new fiscal year that began April 1, Indian power plants are expected to burn about 8% more coal.

India fossil and non-fossil power output India fossil and non-fossil power outputThe rapid acceleration in India's coal-fired output to address a spike in power demand underscores challenges faced by the world's third largest greenhouse gas-emitter in weaning its economy off carbon, as it attempts to ensure energy security to around 1.4 billion Indians.

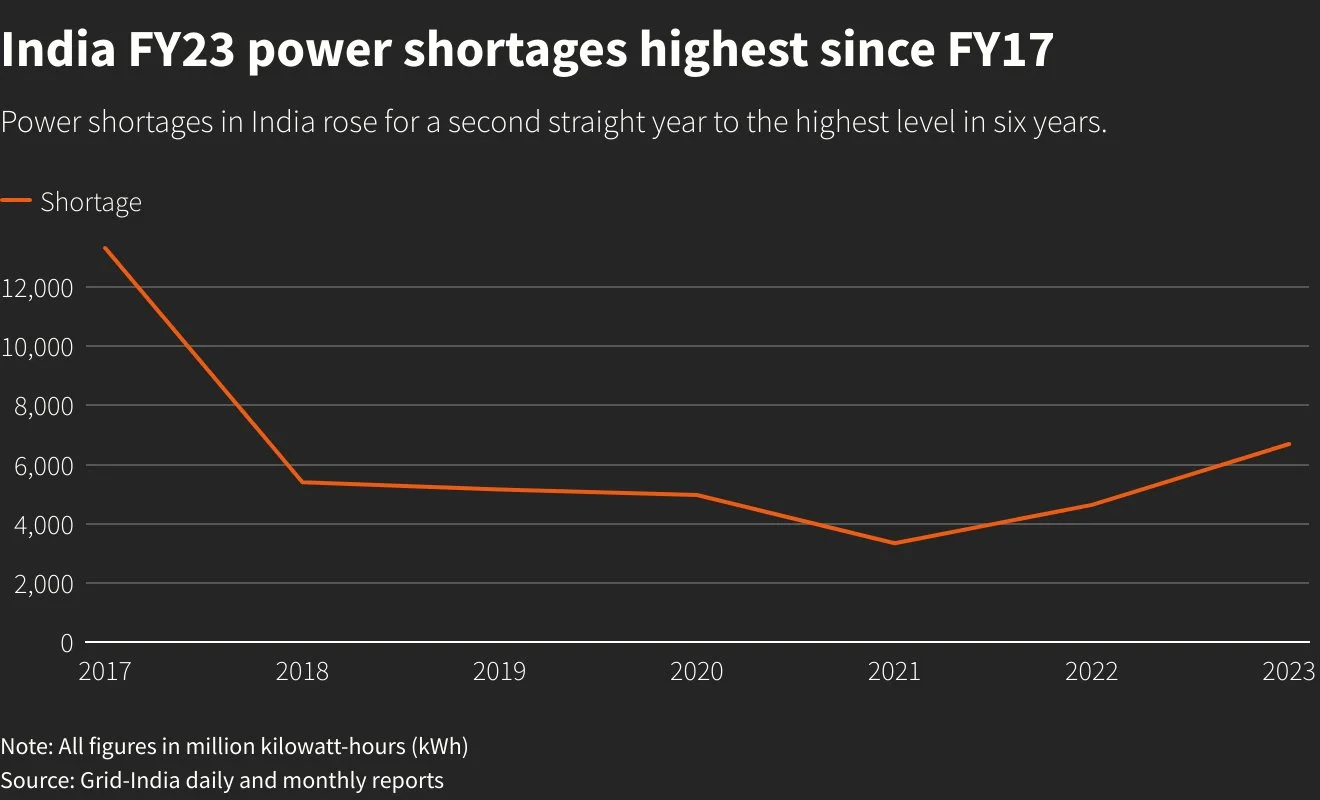

Total power supplied during the last fiscal year was 1509.15 billion kWh, 8.4% higher than a year earlier but still 6.69 billion units short of demand, the widest deficit in six years.

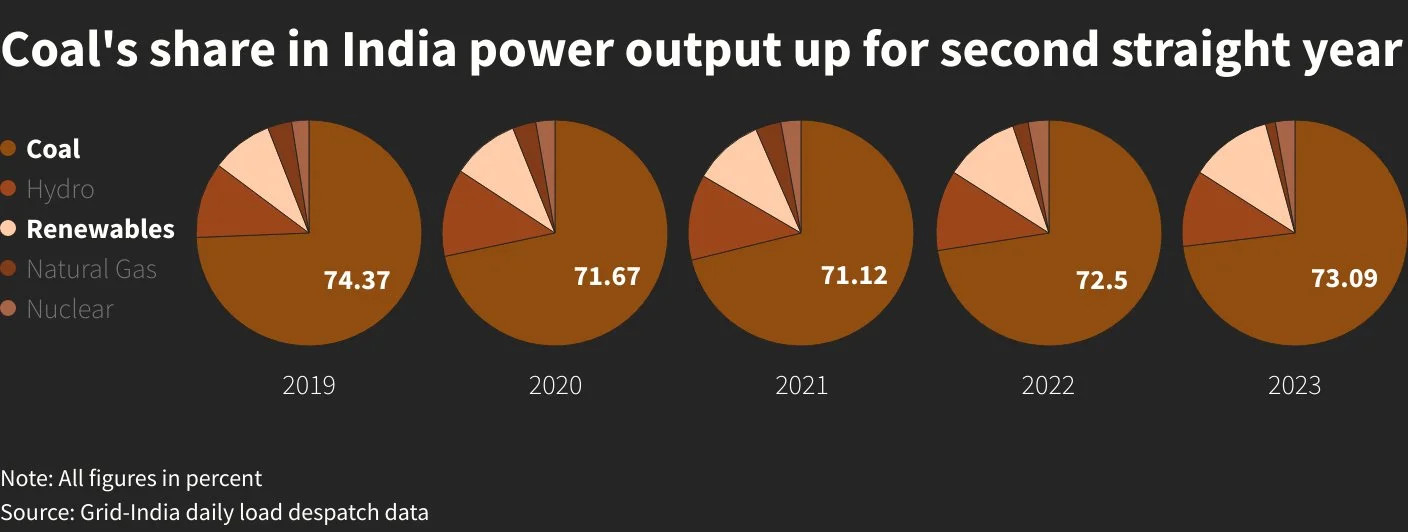

Electricity generated from coal rose to 1,162.91 billion kWh, the data showed, with its share in overall output rising to 73.1% - the highest level since the year ending March 2019.

India's Central Electricity authority estimates that 1 million kWh of power produced from coal generates 975 tonnes of carbon dioxide, while the same amount of power generated from gas produces 475 tonnes. A plant fired by lignite, known as brown coal, emits 1,280 tonnes to produce equivalent power.

RENEWABLES PUSH

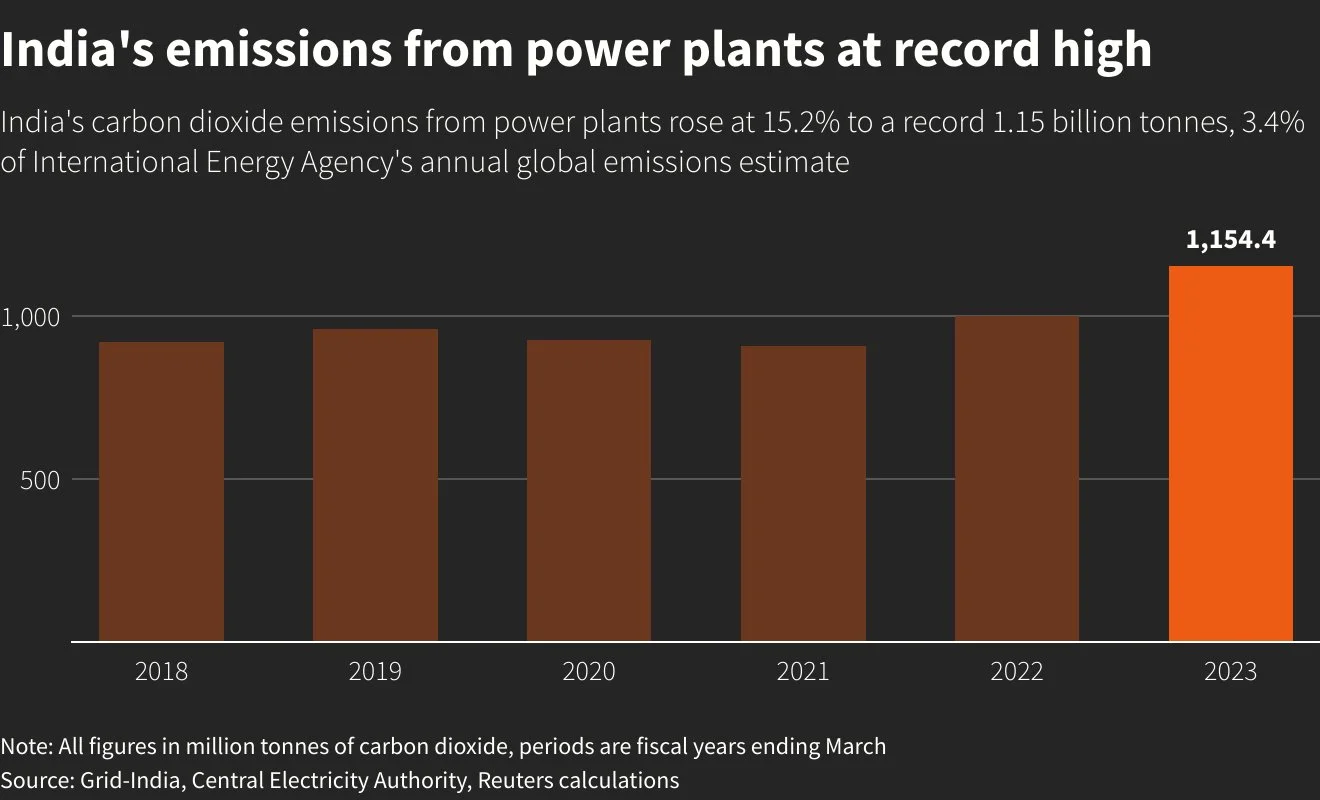

Increased fossil fuel burning for power in the world's fifth largest economy drove up CO2 emissions during the year by nearly a sixth, to 1.15 billion tonnes, Reuters calculations based on government data and emissions estimates show.

That is 3.4% of the International Energy Agency's estimate of annual global emissions of 33.8 billion tonnes in 2022.

Reuters GraphicsMany major countries boosted coal use in the twelve months due to Russia's invasion of Ukraine, but the rise was steepest in India, data from energy think-tank Ember shows.

The government has defended India's high coal use citing lower per capita emissions compared with richer nations and rising renewable energy output.

Reuters GraphicsAfter missing a target to install 175 GW in renewable energy capacity by 2022, India is trying to boost non-fossil capacity - solar and wind energy, nuclear and hydro power, and bio-power - to 500 GW by 2030.

India's solar capacity additions have risen by about a fifth during the just-ended fiscal year, boosting its renewable energy output by a record 33.3 billion units, or 21.7%, to 187.1 billion units.

The green energy output helped prevent as much as 32.5 million tonnes of CO2 emissions from power that would otherwise likely have been produced with coal, calculations show.

The share of renewables in power generation, excluding big hydro and nuclear power, rose to 11.8% in 2022/23, compared with 10.8% the previous year, the data showed, driven mainly by a 35% increase in solar output.

Seaboard: pioneers in power generation in the country

…Armando Rodríguez, vice-president and executive director of the company, talks to us about their projects in the DR, where they have been operating for 32 years.

More than 32 years ago, back in January 1990, Seaboard began operations as the first independent power producer (IPP) in the Dominican Republic. They became pioneers in the electricity market by way of the commercial operations of Estrella del Norte, a 40MW floating power generation plant and the first of three built for Seaboard by Wärtsilä.

Image: By Germán & CoAnalysis: A Surprise Accusation Bolsters a Risky Case Against Trump

The unsealed case against Donald J. Trump accuses him of falsifying records in part to lay the groundwork for planned lies to tax authorities.

NYT By Charlie Savage, Published April 4, 2023WASHINGTON — The unsealed indictment against former President Donald J. Trump on Tuesday laid out an unexpected accusation that bolstered what many legal experts have described as an otherwise risky and novel case: Prosecutors claim he falsified business records in part for a plan to deceive state tax authorities.

For weeks, observers have wondered about the exact charges the Manhattan district attorney, Alvin L. Bragg, would bring. Accusing Mr. Trump of bookkeeping fraud to conceal campaign finance violations, many believed, could raise significant legal challenges. That accusation turned out to be a major part of Mr. Bragg’s theory — but not all of it.

“Pundits have been speculating that Trump would be charged with lying about the hush money payments to illegally affect an election, and that theory rests on controversial legal issues and could be hard to prove,” said Rebecca Roiphe, a New York Law School professor and former state prosecutor.

“It turns out the indictment also includes a claim that Trump falsified records to commit a state tax crime,” she continued. “That’s a much simpler charge that avoids the potential pitfalls.”

The indictment listed 34 counts of bookkeeping fraud related to Mr. Trump’s reimbursement in 2017 to Michael D. Cohen, his former lawyer and fixer. Just before the 2016 election, Mr. Cohen had made a $130,000 hush money payment to the pornographic film actress Stormy Daniels, who has said she and Mr. Trump had an extramarital affair.

Various business records concerning those payments to Mr. Cohen, an accompanying statement of facts said, falsely characterized them as being for legal services performed in 2017. For each such record, the grand jury charged Mr. Trump with a felony bookkeeping fraud under Article 175 of the New York Penal Law. A conviction on that charge carries a sentence of up to four years.

But bookkeeping fraud is normally a misdemeanor. For it to rise to a felony, prosecutors must show that a defendant intended to commit, aid or conceal a second crime — raising the question of what other crime Mr. Bragg would contend is involved.

Bragg Details Charges Against Trump

Alvin L. Bragg, the Manhattan district attorney, accused Donald J. Trump of falsifying business records connected to a hush money payment to a porn star. Mr. Trump pleaded not guilty to all 34 felony counts.CreditCredit...Andrew Seng for The New York Times

On Tuesday, Mr. Bragg suggested that prosecutors are putting forward multiple theories for the second crime, potentially giving judges and jurors alternative routes to finding that bookkeeping fraud was a felony.

As was widely predicted, he is pointing toward alleged violations of both federal and state elections laws. By doing so, he is in part plunging forward with a premise that has given pause to even some of Mr. Trump’s toughest critics.

As a matter of substance, it can be ambiguous whether paying off a mistress was a campaign expenditure or a personal one.

As a matter of legal process, to cite federal law raises the untested question of whether a state prosecutor can invoke a federal crime even though he lacks jurisdiction to charge that crime himself. Still, Article 175 does not say that the second intended crime must be a state-law offense.

To cite state law raises the question of why New York election rules would apply to a federal presidential election, which is governed by federal laws that generally supersede state laws.

At a news conference, Mr. Bragg pointed to both state and federal election law. He cited a New York state election law that makes it a misdemeanor to conspire to promote a candidacy by unlawful means, but did not explain why that law would apply to a presidential election. He also described a federal cap on campaign contributions without indicating why he had the authority to invoke a crime he could not himself charge.

But Mr. Bragg also introduced yet another theory, accusing Mr. Trump of falsifying business records as a way to back up planned false claims to tax authorities.

“The participants also took steps that mischaracterized, for tax purposes, the true nature of the payments made in furtherance of the scheme,” Mr. Bragg wrote in the statement of facts that accompanied the indictment.

How Times reporters cover politics. We rely on our journalists to be independent observers. So while Times staff members may vote, they are not allowed to endorse or campaign for candidates or political causes. This includes participating in marches or rallies in support of a movement or giving money to, or raising money for, any political candidate or election cause.

The statement of facts also described how Mr. Trump paid Mr. Cohen more than Mr. Cohen had paid Ms. Daniels to cover income taxes Mr. Cohen would incur. Mr. Bragg further emphasized that point in his news conference.

His wording was ambiguous in places. At one point, he seemed to suggest that a planned false statement to New York tax authorities was just an example of the ways by which Mr. Trump and Mr. Cohen purportedly violated the state law against conspiring to promote a candidate through unlawful means.

But it is also a crime to submit false information to the state government. At another point Mr. Bragg seemed to put forward an alleged plan to lie to tax authorities — an intention to say Mr. Cohen had earned income for “legal services performed in 2017” to launder what was in reality a repayment — as a stand-alone offense.

In addition to covering up campaign-finance crimes committed in 2016, Mr. Bragg said: “To get Michael Cohen his money back, they planned one last false statement. In order to complete the scheme, they planned to mischaracterize the repayments to Mr. Cohen as income to the New York state tax authorities.”

In the courtroom, the prosecutor Christopher Conroy accused Mr. Trump of causing the Trump Organization to create a series of false business records, adding that he “even mischaracterized for tax purposes the true nature of the payment.”

That prosecutors cited the possibility of planned false statements on tax filings struck some legal specialists as particularly significant, given the speculation over how bookkeeping fraud charges would rise to felonies.

“The reference to false tax filings may save the case from legal challenges that may arise if the felony charges are predicated only on federal and state election laws,” said Ryan Goodman, a law professor at New York University.

Indeed, a range of election-law specialists on Tuesday expressed fresh doubt about whether Mr. Bragg could successfully use campaign finance laws alone to elevate the bookkeeping fraud charges to felonies. Among those skeptics were Richard L. Hasen, a University of California at Los Angeles legal scholar, and Benjamin L. Ginsberg, a longtime election lawyer for the Republican Party and a critic of Mr. Trump.

Even with the addition of the claim about intended false statements to tax authorities, Robert Kelner, the chairman of the election and political law practice group at the firm Covington & Burling, remained uncertain that it would show an intent to commit another crime.

“The local prosecutors seem to be relying in part on a bank shot exploiting Michael Cohen’s guilty plea in a federal campaign finance case,” he said. “But there were serious questions about the legal basis for the case against Cohen, making that a dubious foundation for a case against a former president. Prosecutors also allude vaguely to ‘steps’ taken to violate tax laws, but they say little to establish what that might mean.”

Mr. Trump arriving at the Manhattan courthouse on Tuesday afternoon for his arraignment.Credit...Dave Sanders for The New York Times

Still, Mr. Bragg emphasized that at this stage, prosecutors did not need to go into detail about what other crimes they believe Mr. Trump intended to commit.

But he will eventually have to show his hand. Barry Kamins, a retired New York Supreme Court judge who is now in private practice, said the next phase of the case would require prosecutors to divulge more.

“What is going to happen now is that the prosecutors are obligated to disclose things in discovery,” he said. “Defense counsel will learn in discovery the nature of the elections laws violations and the tax issues that were raised by Mr. Bragg in his statement of facts.”

Image: The landfall facilities of the 'Nord Stream 1' gas pipeline are pictured in Lubmin, Germany, March 8, 2022. Picture taken with a drone. REUTERS/Hannibal Hanschke/File Photo/ Editing by Germán & coExclusive: German insurers renew cover for blast-damaged Nord Stream gas link

“All indicate the pipeline's potential to resume operations following an alleged sabotage attack…

According to five sources with knowledge of the situation, German insurers Allianz and Munich Re have extended their coverage for the damaged Nord Stream 1 gas pipeline, which is under the control of Russia.

Reuters by Jonathan Saul, Carolyn Cohn, Christoph Steitz and John O'Donnell, Editing by Germán & CoLONDON/FRANKFURT, April 4 (Reuters) - German insurers Allianz and Munich Re have renewed cover for the damaged Russia-controlled Nord Stream 1 gas pipeline, five sources with knowledge of the matter said, indicating that its revival has not been ruled out after an alleged sabotage attack.

Insurance by two of Germany's biggest companies is critical for any long-term future of the pipeline, which was the main route for Russian gas to Europe for a decade before the blast last September.

The insurance stands in contrast to Germany's public stance of severing ties with Moscow, but one of the five sources said the German government had not opposed the cover. Most Western investors have written off their stakes in the pipeline.

Munich Re (MUVGn.DE), Allianz (ALVG.DE) and Germany's chancellery declined to comment, while the economy ministry said insurance was not part of the support the government had in the past provided for the pipeline.

Russia has a 51% stake in Nord Stream 1 through a subsidiary of state-owned energy group Gazprom (GAZP.MM).

Some of Nord Stream's German shareholders favour at least preserving the damaged pipeline in case relations with Moscow improve, two people familiar with the matter said separately.

One of the people said that Berlin tolerated such an approach to the infrastructure, even though it has said that energy ties with Russia are severed.

All of the insurance industry and trade sources declined to be named because of the sensitivity of the issue.

The insurance policy covers damage to the pipeline and business interruption issues, one of the sources said.

Having insurance would also facilitate any repair work needed to resume gas supplies under the Baltic Sea to Europe.

While the import of Russian crude oil and oil products is banned under European Union (EU) sanctions, Russian gas imports are allowed. The West, however, is trying to find alternatives.

'OLD LOGIC'

Europe's imports of Russian gas have fallen from around 40% of EU gas supply to less than 10% since Russia's invasion of Ukraine began in February last year.

The economy ministry spokesperson said the aim was to stop using gas from Russia and elsewhere.

"Russia showed everyone last year that it is not a reliable partner," said the spokesperson. "We need more renewable energies and must become independent of fossil imports."

The stance represents a major shift from Germany's previous whole-hearted support for Russian gas, in defiance of warnings from other EU countries and the United States.

Some German officials, politicians and others familiar with German government thinking told Reuters a minority still hoped Nord Stream 1 can be revived, even if few saw any prospect of that happening in the near future.

Michael Kretschmer, conservative leader of the eastern Saxony region, told the Berliner Zeitung newspaper in January the pipeline should be repaired and Germany should retain the option of importing through it again.

Veronika Grimm, one of the government's chief economic experts who advises the chancellery, said Germany's previous policy of relying on cheap Russian gas to support its economy and build political ties was no longer viable.

"There are still some who follow an old logic with regards to rebuilding energy ties to Russia after the (Ukraine) war," Grimm told Reuters.

The economy ministry spokesperson said the Federal government in 2010 supported the construction of Nord Stream 1 with export credit guarantees and a separate financial credit guarantee, adding that there was no further federal support.

In September 2022, several unexplained underwater explosions ruptured the Nord Stream 1 and newly-built Nord Stream 2 pipelines, each more than 1,200-km-long, that link Russia and Germany across the Baltic Sea.

Last month, sources told Reuters Nord Stream's undersea gas pipelines were to be sealed and there were no immediate plans to repair or reactivate them.

Other sources described this process as keeping the pipeline dormant.

OTHER INSURERS

Prior to Russia's invasion of Ukraine last February, Nord Stream 1 was insured by multiple European underwriters including some from the Lloyd's of London market, sources told Reuters.

Industry sources with knowledge of the situation said some Lloyd's underwriters were believed to have cut insurance arrangements that came up for renewal in late 2022 in part because of UK sanctions imposed on an entity connected to Gazprom.

Three of the Lloyd’s syndicates previously involved in insurance cover were unlikely to have renewed their exposure, three of the insurance industry sources said.

However, a fourth source said its underwriting syndicate from the Lloyd's market continued to provide insurance for the project. They all declined to provide further details.

Lloyd's of London declined to comment.

Customers often renew insurance contracts when their property is damaged and this is taken into account when agreeing the contract terms, industry sources said.

Nord Stream 1's policy was a two-year contract which renewed after the first year, two of the sources said. However, policy-holders and insurers can often break such a contract after the first year, depending on the terms, two insurance industry sources said.

It was unclear if insurer Zurich was part of the new arrangemen

Zurich (ZURN.S), which one of the five sources said was among the pipeline's insurers when the damage occurred, declined to comment.

Gazprom is subject to sanctions by Britain, Canada and the United States, as well as some EU restrictions.

Gazprom and Swiss-based Nord Stream AG did not immediately respond to requests for comment.

Image: Editing by Germán & CoChina sends carrier group off Taiwan coast ahead of US meeting

China staged war games around Taiwan last August following the visit to Taipei of then-House Speaker Nancy Pelosi.

Reuters, TodayChinese and Taiwanese flags are seen in this illustration, August 6, 2022. REUTERS/Dado Ruvic/Illustration/File Photo

TAIPEI, April 5 (Reuters) - Taiwan's defence ministry said on Wednesday a Chinese aircraft carrier group was in the waters off the island's southeast coast, the same day President Tsai Ing-wen was due to meet U.S. House Speaker Kevin McCarthy in Los Angeles.

China, which claims democratically-governed Taiwan as its own territory, has warned of unspecified retaliation if the meeting goes ahead.

China staged war games around Taiwan last August following the visit to Taipei of then-House Speaker Nancy Pelosi.

Taiwan's defence ministry said the Chinese ships, which were led by the carrier the Shandong, passed through the Bashi Channel which separates Taiwan from the Philippines and then into waters to Taiwan's southeast.

It said the ships were going for training in the Western Pacific, and that Taiwanese naval and air forces and land-based radar systems closely monitored them.

"The Chinese communists continue to send aircraft and ships to encroach in the seas and airspace around Taiwan," the ministry said.

"In addition to posing a substantial threat to our national security, it also destroys the status quo of regional security and stability. Such actions are by no means the acts of a responsible modern country."

The ministry provided two pictures - one a grainy black and white image of the carrier taken from the air, and the other of a Taiwanese sailor looking at the Shandong and another unidentified ship in the distance.

China has yet to comment on the carrier group, whose appearance also coincided with the arrival in Beijing of French President Emmanuel Macron.

China has sailed its aircraft carriers near to Taiwan before and at similarly sensitive times.

In March of last year, the Shandong sailed through the Taiwan Strait, just hours before the Chinese and U.S. presidents were due to talk.

Taiwan's defence ministry, in its statement about the Shandong's latest mission near the island, said that "external pressure will not hinder our determination to go into the world".

Taiwan's military will continue to closely monitor the situation in the Taiwan Strait, and uphold the principles of "not escalating conflicts, not causing disputes" to deal with any challenges.

China accuses U.S. of using Taiwan as ‘ATM for American arms sellers’

Taiwan is allegedly being utilized by the United States as a "chess piece" in a containment strategy and as a "ATM for American armaments vendors," according to China Central Television.

TWP By Christian Shepherd and Vic Chiang, TODAYBeijing accused the United States and Taiwan of “serious wrongdoing” after Taiwanese President Tsai Ing-wen met with Speaker Kevin McCarthy (R-Calif.) and a bipartisan group of House lawmakers Wednesday, a historic gathering at which both sides reaffirmed their commitment to preserving freedom amid escalating tensions with China.

Various Chinese ministries released coordinated statements condemning the meeting on Thursday morning local time. The Ministry of Foreign Affairs said that the United States had ignored “repeated warnings” against allowing Tsai to visit and promised “resolute and forceful measures to defend national sovereignty and territorial integrity in response to the serious wrongdoing of U.S.-Taiwan colluding together.”

State broadcaster China Central Television accused the United States of using Taiwan as a “chess piece” in a strategy of containment and as an “ATM for American arms sellers.”

The Chinese Communist Party claims the self-governing island democracy of 23 million as part of its territory and regularly threatens to annex Taiwan by force if it formally declares independence.

As of Thursday morning, China had yet to announce large-scale military exercises similar to the display of force it put on after then-House Speaker Nancy Pelosi visited Taipei in August. That earlier meeting on Taiwanese soil was the first time such a senior American politician had come to Taiwan in almost 30 years. China responded by sending warships, jets and missiles to surround Taiwan’s main island in drills that mimicked a partial blockade.

Taiwan’s president meets with McCarthy after warnings from China

Taiwan’s Defense Ministry said that it monitored the passage of China’s Shandong aircraft carrier as it sailed through the Bashi Channel between Taiwan and the Philippines on Wednesday. It came within 200 nautical miles of Taiwan en route to a training exercise in the West Pacific.

“For China, there is no need for a large response,” said Lin Ying-yu, a professor of international relations at Tamkang University in Taiwan, noting that April is peak time for the Chinese military to conduct training exercises. “They are reopening now [after covid], the Japanese foreign minister just visited and now so has the French president. What would other countries see if they launched large-scale military drills at this point?”

A three-day special operation from the Chinese coast guard this week also prompted Taiwan’s Ocean Affairs Council to warn China against infringing on its legal authority, asking Taiwanese vessels to report any attempts by China to board or carry out inspections.

In recent months, China has increased efforts to assert its claimed sovereignty over the Taiwan Strait. Taiwanese scholars worry that beefed-up coast guard patrols are part of this “gray zone” tactic as Beijing gradually alters the delicate balance in the critical waterway.

Taiwanese President Tsai Ing-wen and House Speaker Kevin McCarthy (R-Calif.) deliver remarks to the press after attending a bipartisan leadership meeting at the Ronald Reagan Presidential Library in Simi Valley, Calif., on Wednesday. (Jabin Botsford/The Washington Post)

Tsai’s visit marked the culmination of an eight-year effort to raise Taiwan’s international profile and strengthen relationships with countries that share democratic values with Taipei, even if they do not have formal diplomatic ties. Central to that strategy has been normalizing high-level exchanges with the United States.

Tsai’s meeting with McCarthy at the Ronald Reagan Presidential Library in Simi Valley, Calif., was the first time that Taiwan’s president met with a political leader in the line of presidential succession on U.S. soil since the United States opened diplomatic relations with China in 1979. At the time, the United States agreed that it would break off formal ties with Taiwan, but it has in the decades since maintained highly choreographed unofficial relations with the island.

“It is no secret that today the peace that we have maintained and the democracy which [we] have worked hard to build are facing unprecedented challenges,” Tsai said in brief remarks with McCarthy after their meeting. “We once again find ourselves in a world where democracy is under threat, and the urgency of keeping the beacon of freedom shining cannot be understated.”

Taiwan, like Ukraine, is fighting for democracy, Tsai says in New York

McCarthy repeatedly signaled that lawmakers in both parties are unified in their desire to continue fostering a relationship with Taiwan. “The one thing I hope all countries see is that we’re united in the same approach together, on both sides. And we’re going to speak with one voice when it comes to China or any others when we look at foreign policy,” he said at a news conference following the meeting.

Tsai’s stop in California marks the end of her unofficial meetings with top political leaders throughout the United States that came ahead of a trip to Central American countries that maintain formal diplomatic ties with Taiwan.

Several Democratic and Republican lawmakers said Wednesday that they met with Tsai last week during her stopover in New York. House Minority Leader Hakeem Jeffries (D-N.Y.) said he and Tsai met while she was in New York on Friday, noting in a statement that their encounter resulted in “a very productive conversation about the mutual security and economic interests between America and Taiwan.”

Tsai also met with a bipartisan group of senators — including Sens. Joni Ernst (R-Iowa), Mark Kelly (D-Ariz.) and Dan Sullivan (R-Alaska) — in New York on Friday, Ernst’s office confirmed Wednesday.

Image: Germán & CoCooperate with objective and ethical thinking…

The 'Hoegh Esperanza' Floating Storage and Regasification Unit (FSRU) is anchored during the opening of the LNG (Liquefied Natural Gas) terminal in Wilhelmshaven, Germany, December 17, 2022. Michael Sohn/Pool via REUTERS/File Photo/ Editing by Germán & CoEnergy firms bet big on German port as clean energy hub

The company stated in an email response that "feasibility studies are presently being developed for both projects, which will provide further insights into their practicability."

REUTERS By Vera Eckert, TODAY, EDITING BY GERMán & COWILHELMSHAVEN, Germany, April 6 (Reuters) - Germany's only deep water port, home to its largest naval base, is where energy firms now plan to spend more than $5.5 billion to help construct the clean energy infrastructure the country needs to help end its reliance on Russian gas.

Europe's leading industrial exporter has only just managed to get through an energy crunch by rushing to build makeshift floating infrastructure for importing liquefied natural gas (LNG), aiming to partially plug the gap left by Moscow's cuts.

But with energy firms already looking beyond LNG in efforts to reduce fossil fuel use, the port of Wilhelmshaven on Germany's northern coast is emerging as a hub for the infrastructure which is needed for hydrogen and ammonia imports, hydrogen production and offshore carbon emissions storage.

"We will become the pumping heart of Germany by 2030," said Alexander Leonhardt, who heads the business development agency for Wilhelmshaven, which has a population of 80,000. Challenges to its development include concerns about disturbing wildlife in the sensitive Wadden Sea and the risks of LNG overcapacity.

Uwe Oppitz of Rhenus Ports, who speaks for Energy Hub Port Wilhelmshaven, said that Wintershall Dea (WINT.UL) (BASFn.DE), Uniper (UN01.DE) and Tree Energy Solutions (TES) plan to spend a total of more than 5 billion euros at Wilhelmshaven.

Energy Hub Port Wilhelmshaven comprises 30 companies, which include E.ON (EONGn.DE), RWE (RWEG.DE) and Orsted (ORSTED.CO), as well as Wilhelmshaven's home state of Lower Saxony.

Oppitz said the investment, the magnitude of which has not previously been reported, will be made between 2026 and 2030, adding that the overall figure was disclosed on condition that no breakdown would be published.

TES, which is backed by Belgium private investment firm AtlasInvest, said the total sum was plausible.

Wintershall Dea said it is planning two projects, called BlueHyNow and CO2nnectNow.

"Feasibility studies are currently being prepared for both projects, which will provide further insights into their practicability," the company said in an emailed comment.

"Wintershall Dea plans to invest around 1 billion euros in the Wilhelmshaven site together with its partners," it said.

Uniper was not immediately available for comment.

The investment commitment is raising hopes that money and jobs can be funnelled into what is a relatively weak region economically and that it may even attract some companies to relocate from Germany's industrial heartland in the south.

Planned investments include electrolysis plants that could be scaled up to more than 1 gigawatts (GW) size, Oppitz said.

Wilhelmshaven is not only the landing point for pipelines and vessels, it has a flourishing offshore wind presence and gas storage caverns, while rail links from legacy activities are also a potential draw for new investment.

Reuters Graphics Reuters GraphicsGREEN HYDROGEN RUSH

Already home to Germany's first floating LNG terminal (FSRU), which is operated by state-controlled Uniper, Wilhelmshaven is also where TES is due to bring another FSRU into service by the end of this year.

Both companies are planning for clean gas production to begin in the second half of this decade.

And while Wintershall Dea will not get involved in LNG, it wants to repurpose some Norwegian pipeline gas imports for hydrogen production, capturing carbon dioxide from the process and exporting it in liquefied form for permanent subsea storage.

Wilhelmshaven's mayor Carsten Feist said he expects to create 1,000-2,000 jobs over the next five years and double corporate tax revenue, if such plans proceed.

To lessen their bills, the companies will tap funds under the European Union's Projects of Common Interest funding (PCI) scheme, hoping for grants to the tune of 30-50%, said Oppitz.

TES said it is confident no subsidies will be needed for its projects.

Paper maker PKV, a big employer 13 kilometres south of Wilhelmshaven, plans a new factory that working with the port projects could perhaps use waste heat from planned electrolysis plants that produce green hydrogen from renewable electricity.

And steelmaker Salzgitter (SZGG.DE) has already struck a deal with Uniper to receive green hydrogen for its steel mill processes, replacing essential fossil-fuel produced hydrogen.

Oppitz said that other firms are assessing the opportunities Wilhelmshaven offers, with clean hydrogen primarily needed by refineries, chemicals, fertilisers and metals makers while industry might welcome carbon storage options.

The Wilhelmshaven business promotion agency estimates that the region could produce more than 30 terawatt hours (TWh) of hydrogen a year from 2030. This alone would represent a quarter of Germany's demand for green hydrogen at that date, namely 95-130 TWh, according to its national hydrogen strategy.

Wintershall Dea wants to grow with that market, said project leader Andreas Moeller.

He rejected suggestions that carbon capture and storage (CCS) strategies are simply a way for fossil fuels to survive.

"We don't want to push green hydrogen to the side. On the contrary, we want to support its ramp-up," he said.

Gundolf Schweppe, chief executive of Uniper Energy Sales said it plans to bring up to 2.6 million tonnes of green ammonia into Wilhelmshaven a year in the second half of this decade.

That is not far off Germany's current production of ammonia, a fertiliser raw material, of 3 million tonnes a year.

Meanwhile, TES wants to bring renewable methane under the name electric natural gas (e-NG) from solar power made overseas into Wilhelmshaven from 2027.

News round-up, April 4, 2023

Most read…

White House announces clean energy initiatives on coal

On Tuesday, the White House said that it was directing hundreds of millions of dollars toward supporting coal communities, including $450 million for sustainable energy initiatives in both active and past mining regions.

REUTERSStormy Daniels: Woman at center of Trump indictment is porn star turned ghostbuster

The alleged 2006 sexual encounter between adult movie star Stormy Daniels and former president Donald Trump has helped her create a sizable economic empire.

Reuters By Julia Harte, editing by Germán & CoNew York Already Knows a Lot About Donald Trump…

...a "SOROS BACKED ANIMAL." Mr. Trumph said.

While awaiting the indictment, the former president referred to Mr. Bragg in an anti-Black and anti-Semitic manner on Truth Social, calling him a "SOROS BACKED ANIMAL." Law enforcement authorities had to prepare for potential street unrest on Tuesday because Mr. Trump threatened "death and destruction" and called for large-scale protests before being indicted.

NYT, By Mara Gay, April 4, 2023, editing by Germán & CoOPEC+ oil cut delivers blow to ECB

The action consists of putting additional pressure on European governments when voters from London to Berlin are unsatisfied with the rising expenses of energy, food, and transportation. Support for politicians has declined as individuals have struggled to pay their costs, leading to protests and industrial unrest. The West's reaction to Russia's invasion of Ukraine and other factors contributing to inflation is not getting any less important.

Analysts expect the supply crunch to negatively impact inflation in Europe.

POLITICO EY BY PAOLA TAMMA, EDITING BY GERMÄN & CO, APRIL 3, 2023 There ought to be no hiding place for Putin

Successful charges before an international tribunal would fully recognize the crime allegedly being committed by its full and proper name — the crime of aggression.

POLITICO EU BY AARIF ABRAHAM, TODAYImage: Germán & CoMost read…

White House announces clean energy initiatives on coal

On Tuesday, the White House said that it was directing hundreds of millions of dollars toward supporting coal communities, including $450 million for sustainable energy initiatives in both active and past mining regions.

REUTERSStormy Daniels: Woman at center of Trump indictment is porn star turned ghostbuster

The alleged 2006 sexual encounter between adult movie star Stormy Daniels and former president Donald Trump has helped her create a sizable economic empire.

Reuters By Julia Harte, editing by Germán & CoNew York Already Knows a Lot About Donald Trump…

...a "SOROS BACKED ANIMAL." Mr. Trumph said.

While awaiting the indictment, the former president referred to Mr. Bragg in an anti-Black and anti-Semitic manner on Truth Social, calling him a "SOROS BACKED ANIMAL." Law enforcement authorities had to prepare for potential street unrest on Tuesday because Mr. Trump threatened "death and destruction" and called for large-scale protests before being indicted.

NYT, By Mara Gay, April 4, 2023, editing by Germán & CoOPEC+ oil cut delivers blow to ECB

The action consists of putting additional pressure on European governments when voters from London to Berlin are unsatisfied with the rising expenses of energy, food, and transportation. Support for politicians has declined as individuals have struggled to pay their costs, leading to protests and industrial unrest. The West's reaction to Russia's invasion of Ukraine and other factors contributing to inflation is not getting any less important.

Analysts expect the supply crunch to negatively impact inflation in Europe.

POLITICO EY BY PAOLA TAMMA, EDITING BY GERMÄN & CO, APRIL 3, 2023

There ought to be no hiding place for Putin

Successful charges before an international tribunal would fully recognize the crime allegedly being committed by its full and proper name — the crime of aggression.

POLITICO EU BY AARIF ABRAHAM, TODAY“We’re living in a volatile world…

it’s easy to get distracted by things like changeable commodity prices or a shortage of solar panels. But this wouldn’t be true to our purpose – we can’t allow ourselves to lose sight of our end goal; said Andres Gluski, CEO of energy and utility AES Corp

Image: A general view of the White House in Washington, U.S., July 21, 2022. REUTERS/Kevin Lamarque/File Photo, Editing by Germán & CoWhite House announces clean energy initiatives on coal

On Tuesday, the White House said that it was directing hundreds of millions of dollars toward supporting coal communities, including $450 million for sustainable energy initiatives in both active and past mining regions.

ReutersWASHINGTON, April 4 (Reuters) - The White House said on Tuesday it was funneling hundreds of millions of dollars to help coal communities, including $450 million for clean energy projects on current and former mining areas.

The Department of Energy will also provide $16 million to the University of North Dakota and West Virginia University to complete design studies for a domestic refinery that will extract rare earth and other critical minerals from coal ash, acid mine drainage and other mine waste, the White House said.

"This project will help strengthen American supply chains, revitalize energy communities, and reduce reliance on competitors like China," the White House said in a statement.

The government action also includes putting 11 federal agencies to work in tandem on getting new resources into energy communities like former coal mining towns, it said.

The Treasury Department and Internal Revenue Service will release guidance on Tuesday that will allow developers of clean energy projects and facilities to tap into billions of dollars in boneses, in addition to existing tax credits, it said.

The funding for this initiative comes from the Inflation Reduction Act and the Bipartisan Infrastructure Law, the White House said.

Seaboard: pioneers in power generation in the country

…Armando Rodríguez, vice-president and executive director of the company, talks to us about their projects in the DR, where they have been operating for 32 years.

More than 32 years ago, back in January 1990, Seaboard began operations as the first independent power producer (IPP) in the Dominican Republic. They became pioneers in the electricity market by way of the commercial operations of Estrella del Norte, a 40MW floating power generation plant and the first of three built for Seaboard by Wärtsilä.

Image: By Germán & CoStormy Daniels: Woman at center of Trump indictment is porn star turned ghostbuster

The alleged 2006 sexual encounter between adult movie star Stormy Daniels and former president Donald Trump has helped her create a sizable economic empire.

Reuters By Julia Harte, editing by Germán & CoWho's who in Trump hush money case

April 4 (Reuters) - Adult film star Stormy Daniels has built a lucrative business empire around her alleged 2006 sexual encounter with former President Donald Trump and earned legions of fans for her breezy retorts to those who cast her as an immoral woman.

Her popularity and profits appeared to get a boost with the news of Trump's indictment on Thursday in a case involving a $130,000 hush payment she received in the waning days of his 2016 election campaign.

"Thank you to everyone for your support and love!" she posted on Twitter after news of the criminal charges broke. "#Teamstormy merch/autograph orders are pouring in."

Daniels, 44, is an author, director and media personality. She launched her own reality TV show, "Spooky Babes", in which she searches haunted houses as a "paranormal investigator", and she once flirted with a U.S. Senate bid as a Democrat-turned-Republican.

When a Twitter user asked what "the whore" was doing one day this week, Daniels responded, "Not sure why you're curious but... Just fed my horse and mucked stalls, signing photos and #teamstormy shirts and mailing them, booking crew/location for a music video I'm directing, floating in my pool and then my live show."

"Basically the usual," she added.

She is not shy about capitalizing on the attention around her connection to Trump. She points out he has done the same - but, in her view, has faced far less criticism.

"You take the opportunity," Daniels said on a Wednesday livestream on OnlyFans, an online subscription platform known for adult content, according to a report by British newspaper The Independent. "Isn't that what America is all about?"

Trump has raised more than $2 million for his legal defense since predicting on March 18 that he would soon be arrested, according to his campaign. A Trump fundraising group sent an email asking supporters for more contributions after his indictment.

After he announced his impending arrest, searches for Daniels on the website Pornhub jumped 21,655%, according to the site's research and analysis branch.

A spokesperson for Daniels could not be reached for comment.

'VINDICATION'

Daniels, whose real name is Stephanie Clifford, is married to a fellow adult film star and has a young daughter and a horse farm, according to her social media profiles.

Her childhood was marred by sexual assault and poverty. Growing up in Louisiana with a single mother, "we were just trash. And my mom was a trainwreck, and my clothes didn't fit, and I was poor and I smelled," Daniels told Vice News in 2021.

Daniels said she had been a straight-A student and editor of her high school newspaper when she left home and started stripping to support herself.

She continued working in adult entertainment after graduating high school and began her career in adult films in 2002, according to the Vice News interview. Daniels soon began winning industry awards and landed roles in TV shows and films such as "The 40-Year-Old Virgin" and "Knocked Up".

Daniels has said she received the hush money in exchange for keeping silent about a sexual encounter she had with Trump in 2006. Trump has denied having the affair and initially disputed knowing anything about the payment.

It is unclear what charges he will face, and he has signaled he will continue his 2024 bid for the presidency as he fights the case.

In an interview with Britain's Times newspaper on Friday, Daniels called the indictment "vindication" and referred to a vulgar comment Trump made in a 2005 recording in which he boasted about forcing himself on women.

"But it's bittersweet," she said. "He's done so much worse that he should have been taken down before. I am fully aware of the insanity of it being a porn star. But it's also poetic; this pussy grabbed back."

Image: NYT, editing by Germán & coNew York Already Knows a Lot About Donald Trump…

...a "SOROS BACKED ANIMAL." Mr. Trumph said.

While awaiting the indictment, the former president referred to Mr. Bragg in an anti-Black and anti-Semitic manner on Truth Social, calling him a "SOROS BACKED ANIMAL." Law enforcement authorities had to prepare for potential street unrest on Tuesday because Mr. Trump threatened "death and destruction" and called for large-scale protests before being indicted.

NYT, By Mara Gay, April 4, 2023, editing by Germán & CoMs. Gay is a member of the editorial board.

If Donald J. Trump seems a little on edge lately, so does the city where he made his name.

The former president, after largely eluding legal accountability of any kind for decades, has now been indicted by a grand jury in a case brought by the Manhattan district attorney, Alvin Bragg.

So far Mr. Trump has handled the investigation, which has looked into whether he broke laws while paying hush money to a porn star ahead of the 2016 election, exactly as one might imagine: with the minimum amount of class and the maximum use of racist slurs. Not only has he made sure everyone knows Mr. Bragg is Black, he has also suggested he is subhuman.

“HE IS A SOROS BACKED ANIMAL,” the former president told his followers on Truth Social while waiting for the indictment, using anti-Black racism as well as antisemitism to describe Mr. Bragg. Mr. Trump also called for widespread protests before he was indicted and predicted “death and destruction,” forcing law enforcement agencies to prepare for possible violence in the streets on Tuesday, when he is expected to be arraigned.

All of this has made New York City, his former hometown, a bit anxious, too. The wait for Mr. Trump’s arraignment and any backlash that may come from it has the city unnerved.

Few Americans have seen Mr. Trump shimmy his way out of a jam more often than New Yorkers. We’ve seen him bounce back from bankruptcy six times, and he has never been truly held to account for his long history of excluding Black people from the rental properties that helped make him rich. We’ve seen his political fortunes soar despite credible claims of sexual assault and tax fraud. We’ve watched up close his gravity-defying, horrifying metamorphosis from a tacky real estate developer and tabloid fixture into a C-list celebrity and, finally, a one-term president with authoritarian aspirations.

Given that history, the idea that Mr. Trump will soon be fingerprinted and booked in a New York courthouse has left many in disbelief. A kind of collective angst over the Trump prosecution has settled over New York City, where many deeply disdain him but seem unconvinced he will ever truly be held to account.

During a recent stage performance of “Titanique,” the hit musical comedy and glitter-filled parody of the 1997 film about the doomed ship, Russell Daniels, the actor playing Rose’s mother, let out a kind of guttural scream. “It’s not fair that Trump hasn’t been arrested yet!” Mr. Daniels cried. Inside the Manhattan theater, the audience roared.

In Harlem recently, the Rev. Al Sharpton held a prayer vigil for Mr. Bragg, who received threats after Mr. Trump used his social media platform to share a menacing photograph of himself with a baseball bat juxtaposed with a photo of the district attorney, in a clear hint of his violent mind-set.

“We want God to cover him and protect him,” Mr. Sharpton said, referring to Mr. Bragg. “Whatever the decision may be, whether we like it or not, but he should not have to face this kind of threat, implied or explicit. Let us pray.”

New Yorkers, weary and still recovering from the pandemic Mr. Trump badly mismanaged, are also now bracing themselves for the possibility of demonstrations by the former president’s supporters. In the hours after the indictment on March 29, N.Y.P.D. helicopters hovered over the courthouses of Lower Manhattan and officers set up barricades along largely empty streets. The Police Department ordered all roughly 36,000 uniformed members to report for duty amid bomb threats and the arrest of one Trump supporter with a knife.

The inevitable spectacle began on Monday, when television helicopters tracked every inch of Mr. Trump’s motorcade from LaGuardia Airport to Manhattan, as if he were visiting royalty. The courthouse area downtown is expected be largely closed to traffic on Tuesday. All Supreme Court trials in the Manhattan Criminal Courts Building will be adjourned early. There are also police lines and TV trucks around Trump Tower, where the former president stayed on Monday night. Meanwhile, Republican groups and Trump supporters are planning or sponsoring rallies nearby, one of which will be addressed by Representative Marjorie Taylor Greene, who will bring her destructive rhetoric up from Georgia.

Of the four known criminal investigations Mr. Trump faces, the Manhattan case is seen by some legal experts as the least serious, in part because it may involve allegations of campaign finance violations before his presidency rather than attempts to abuse his office by overturning the results of an election or inciting supporters to effectively overthrow the United States government. Fair enough.

Still, it’s a poetic irony that the former president will face his first criminal indictment in New York City, the town where he sought to burnish his “law and order” credentials. In 1989, Mr. Trump took out a notorious ad in several newspapers, including The New York Times, calling for the reinstatement of the death penalty when a group of Black and Latino teenagers were accused of the sexual assault of a jogger in Central Park. After serving prison sentences that varied from six to 13 years, the teens were exonerated.

“What has happened to the respect for authority, the fear of retribution by the courts, society and the police for those who break the law, who wantonly trespass on the rights of others?” Mr. Trump wrote in the 1989 ad. “How can our great society tolerate the continued brutalization of its citizens by crazed misfits?”

Over many years, New York has learned a painful lesson. Mr. Trump and his many misdeeds are best taken seriously.

Image: Editing by Germán & CoOPEC+ oil cut delivers blow to ECB

The action consists of putting additional pressure on European governments when voters from London to Berlin are unsatisfied with the rising expenses of energy, food, and transportation. Support for politicians has declined as individuals have struggled to pay their costs, leading to protests and industrial unrest. The West's reaction to Russia's invasion of Ukraine and other factors contributing to inflation is not getting any less important.

Analysts expect the supply crunch to negatively impact inflation in Europe.

The move is seen by analysts as a deliberate attempt by the group's largest countries to push the price of oil higher | Patrick T. Fallon/AFP via Getty Images

POLITICO EY BY PAOLA TAMMA, EDITING BY GERMÄN & CO, APRIL 3, 2023 A shock cut in oil output by the OPEC+ group has thrown a spanner into central banks' efforts to tame inflation just as pressure on Europe's cost of living was starting to ease.

The announcement on Sunday by the oil-producing cartel of a reduction of over 1 million barrels per day ― forcing the price up by as much as 8 percent by Monday morning ― has stoked fears of a knock-on effect on the economy as a whole. It comes at a time when inflation is only just starting to slow after reaching record rates in the eurozone since the summer.

It will take about two months for the OPEC+ decision to trickle down to the real economy, as current crude prices make their way to oil products, said Jorge León, senior vice president of Rystad Energy, a market intelligence firm. This will "most likely" increase inflation.

"That's a problem for Europe, because oil prices are very relevant for headline inflation in Europe" as a net importer of oil, he said. Future gasoline contracts are already trading at higher prices.

The move heaps more pressure on European governments at a time when rising costs of energy, food and transport have sown discontent among voters from London to Berlin. As people have struggled to pay bills, support for leaders has slipped and has triggered a wave of protests and industrial unrest. One of the many drivers of inflation ― Russia's invasion of Ukraine and the West's response to it ― shows little sign of becoming any less critical.

Money supply

Closer to home, higher inflation also may encourage the European Central Bank to continue tightening the money supply by putting up interest rates, and this in turn could have consequences for growth in the eurozone.

"What I'm worried about is the impact that this could have, first of all, on inflation, and therefore, on the attitudes of central banks, and therefore, on economic growth perspectives for this year and for next year," said León.

Annual inflation in the eurozone dropped to 6.9 percent in March from 8.5 percent in February having hit a record 10.6 percent in October. In an effort to bring it back to its 2 percent target, the ECB has continued to increase interest rates from -0.5 percent last summer to 3 percent in March — its fastest-ever tightening cycle.

The Opec+ decision was led by Saudi Arabia, it's most powerful member. This move, together with Saudi's continuing cooperation with Russia, adds to tension with the US and European governments as they struggle to present a united front on Moscow's aggression.

"The dramatic cut [in oil production] will only add to pressing global inflationary squeezes," said Nigel Green, CEO of deVere Group, an independent financial adviser. "There's real concern that the surprise decision announced by Saudi Arabia for OPEC+ will prompt central banks to maintain interest rates higher for longer due to the inflationary impact, which will hinder economic growth."

The move sent prices jumping from just under $80 per barrel of crude at market close on Friday to over $85 at one point on Monday, before falling back slightly. Analysts immediately raised their expectations for future oil prices, with Goldman Sachs projecting crude to reach $95 a barrel by the end of the year.

Concerns linger

It was the second slash in output announced by OPEC+ in under a year, after last fall it cut production by 2 million barrels per day — a decision that was sharply criticized by the U.S.

Non-OPEC countries can do little to counter the effort to push the price of oil higher at a global level | Vladimir Simicek/AFP via Getty Images

The move is seen by analysts as a deliberate attempt by the group's largest countries to push the price of oil higher. It hovered around the $100 a barrel mark last year.

Non-OPEC countries, including the U.S. and those of the EU, can do little to counter the effect, given historically low levels of crude oil reserves. U.S. reserves, which Washington can decide to release to counter some of the supply crunch, are at their lowest since 1984.

"It will take some time to see exactly how much this impacts global prices as demand concerns linger, but this is another potential factor exerting upward pressure on inflation," analysts at Deutsche Bank wrote in a note.

Opec, the Organization of the Petroleum Exporting Countries, was expanded to become Opec+ in 2016 to bring in countries including Russia as crude oil prices fell.

Image: Germán & CoCooperate with objective and ethical thinking…

Image: NYT EDITING BY GERMÁM & COThere ought to be no hiding place for Putin

Successful charges before an international tribunal would fully recognize the crime allegedly being committed by its full and proper name — the crime of aggression.

POLITICO EU BY AARIF ABRAHAM, TODAY

Aarif Abraham is a British barrister and a member of Garden Court North Chambers and Accountability Unit in London.

The International Criminal Court’s (ICC) arrest warrant for Russian President Vladimir Putin on the war crime of unlawfully deporting children to Russia is a historic moment for intentional criminal justice. It is only the third time the ICC has issued indicative charges against a serving head of state, and the first time against that of a U.N. Security Council member.

The warrant starts a process that runs in parallel with another first — the initiative to create a Special Tribunal for the crime of aggression as allegedly being committed in Ukraine. It would be the first aggression-focused tribunal since Nuremberg and Tokyo, which prosecuted axis-power leaders after World War II.

If created, such a tribunal could prosecute senior military and political leaders for what the 1946 Nuremberg judgment called the “supreme international crime.” Why? Because had the manifestly illegal acts of aggression — such as invasion, attack or occupation — not occurred, the egregious harm inflicted on civilians, including tens of thousands of war crimes, would never have happened.

But the ICC cannot prosecute the crime of aggression in relation to Ukraine, only other international crimes like war crimes, crimes against humanity or genocide. The only way for the ICC to prosecute the crime of aggression would be either with Russia’s consent, or through a U.N. Security Council referral. And it is for this reason the initiative for a tribunal led by Ukraine has received the active backing and strong engagement of over 30 countries — and the list is growing.

So, where does the ICC arrest warrant for Putin leave both processes, and which is more likely to succeed? The truth is, the ICC route and the tribunal route are highly complementary.

First, Ukraine rightly wishes to see all responsible military and political leaders in Russia and Belarus held to account for the totality of the harm resulting from aggression. And there would be far more senior leaders caught by the aggression net than the ICC net, which requires a strong evidential link between international crimes being committed by soldiers on the ground and senior leaders in Russia and Belarus. This usually makes such crimes difficult to decisively prove — particularly when Russia claims its actions, such as the deportation of children, are motivated by humanitarian concerns.

By contrast, the crime of aggression is easier to prosecute, as it goes straight to the top and does not require extensive testimonial evidence, given its focus on the high-level acts of the armed forces. It may, however, likely require significant material from intelligence and military sources.

Second, Russia heavily contests the ICC’s jurisdiction to try nationals of countries that are not its members — countries that include Russia, the United States and China. So, while the ICC’s 123 members are under a legal duty to apprehend Putin, executing the arrest warrant will be a source of immense political, and possibly legal, contention, as there is a view that serving heads of state enjoy personal immunity from arrest or prosecution — especially before courts to which they do not belong.

Thus, the consequences for a country apprehending the Russian head of state are not likely to be insignificant, but a special tribunal would face a similar challenge —although a different pool of states may back it. And in such a case, the support of powerful countries like the U.S., which has now been confirmed, could decisively strengthen the possibility of apprehending Putin, and provide some degree of immunity from Russian retaliation in enforcing any arrest warrants.

Third, the ICC route is clear, and its jurisdiction derives from a treaty that its 123 members agreed to adhere to.

The tribunal would likely be created by a similar treaty, ideally agreed with the U.N. General Assembly and/or the European Union and/or multilaterally. Its jurisdiction could be inherent from the extant prohibition on aggression under international law, which binds states through custom, combined with the prohibition on aggression under Ukrainian law. Incidentally, there is a prohibition on aggression under Belarusian and Russian law too — a concept that was ironically pioneered, and strongly advocated for, by the Soviet Union in response to the horrors it suffered during World War II.

A man looks at his vehicle parked outside a destroyed building after a deadly strike in the city of Sloviansk in Eastern Ukraine, on March 27, 2023 | Aris Messinis/AFP via Getty Images

Considering the continuing aggression, and the risk of further contagion to other countries, both the ICC and special tribunal routes ought to run on a parallel track, for continued backing for a tribunal means there would be no hiding place for senior Russian and Belarusian leaders.

And successful charges before such a tribunal would not only encapsulate the horrors of the harm suffered, but it would finally recognize the crime allegedly being committed by Putin and those around him by its full and proper name.

News round-up, April, 3, 2023

Most read…

In Surprise, OPEC Plus Announces Cut in Oil Production

Oil prices soared 7 percent on Sunday night after the group’s move to cut 1.2 million barrels a day.

NYT BY CLIFFORD KRAUSS, NOW World Bank Warns of Lost Decade for Global Economy

Lender sees demographics, war and pandemic aftereffects holding back growth

WSJ BY HARRIET TORRY, APRIL 2, 2023 Janet Yellen Says Bank Rules Might Have Become Too Loose

Treasury secretary argues that efforts to protect financial stability are incomplete

WSJ BY ANDREW DUEHRENExclusive: Russia shifts to Dubai benchmark in Indian oil deal - sources

The two state-controlled firms' move to leave the Brent standard, which is favored by Europe, is a part of a shift in Russia's oil sales toward Asia after Europe boycotted Russian oil after its invasion of Ukraine more than a year ago.

REUTERS BY NIDHI VERMADollar ahead as inflation worries resurface after OPEC+ surprise

The Organization of the Petroleum Exporting Countries (OPEC) and its allies, also known as OPEC+, announced data on Friday that revealed that U.S. consumer spending increased moderately in February after surging the previous month, with inflation showing some signs of cooling even though it remained high.

REUTERS BY ANKUR BANERJEE. EDITING BY GERMÁN & COJustice Department has more evidence of possible Trump obstruction in documents probe, Washington Post reports

According to the Post, which cited people familiar with the investigation, Trump looked through some of the boxes of government records in his home after his advisers were served with a subpoena in May demanding the return of the classified records out of an apparent desire to keep certain things in his possession.

REUTERS, EDITING BY GERMÁN & COImage: Germán & CoMost read…

In Surprise, OPEC Plus Announces Cut in Oil Production

Oil prices soared 7 percent on Sunday night after the group’s move to cut 1.2 million barrels a day.

NYT BY CLIFFORD KRAUSS, NOW World Bank Warns of Lost Decade for Global Economy

Lender sees demographics, war and pandemic aftereffects holding back growth

WSJ BY HARRIET TORRY, APRIL 2, 2023 Janet Yellen Says Bank Rules Might Have Become Too Loose

Treasury secretary argues that efforts to protect financial stability are incomplete

WSJ BY ANDREW DUEHRENExclusive: Russia shifts to Dubai benchmark in Indian oil deal - sources

The two state-controlled firms' move to leave the Brent standard, which is favored by Europe, is a part of a shift in Russia's oil sales toward Asia after Europe boycotted Russian oil after its invasion of Ukraine more than a year ago.

REUTERS BY NIDHI VERMADollar ahead as inflation worries resurface after OPEC+ surprise

The Organization of the Petroleum Exporting Countries (OPEC) and its allies, also known as OPEC+, announced data on Friday that revealed that U.S. consumer spending increased moderately in February after surging the previous month, with inflation showing some signs of cooling even though it remained high.

REUTERS BY ANKUR BANERJEE. EDITING BY GERMÁN & COJustice Department has more evidence of possible Trump obstruction in documents probe, Washington Post reports